Some Of Loan Apps

Wiki Article

The Buzz on Instant Cash Advance App

Table of ContentsGetting The $100 Loan Instant App To WorkSome Known Facts About Instant Loan.Best Personal Loans Can Be Fun For Everyone$100 Loan Instant App - TruthsThe Ultimate Guide To Loan AppsInstant Loan - Truths

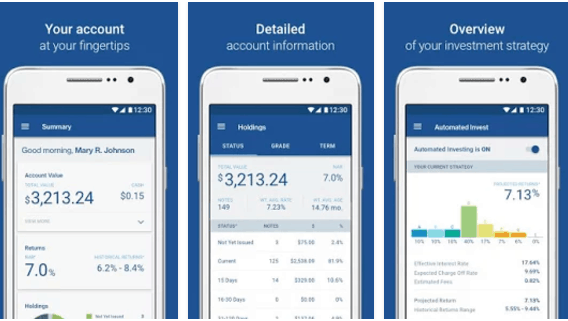

When we assume regarding making an application for financings, the imagery that enters your mind is people aligning in lines up, awaiting many follow-ups, and also getting utterly distressed. Technology, as we understand it, has altered the face of the financing service. In today's economic climate, customers and also not lenders hold the trick.Finance authorization and documentation to funding handling, everything is online. The many relied on online financing applications supply customers a platform to look for loans conveniently as well as give approval in mins. You can take an from several of the most effective cash car loan applications readily available for download on Google Play Shop and also App Shop.

You just have to download the app or go to the Pay, Feeling web site, authorize up, submit the required files, as well as your lending will certainly obtain authorized. You will obtain notified when your financing request is processed.

What Does Best Personal Loans Do?

Typically, also after obtaining your funding approved, the process of obtaining the finance amount transferred to you can require time and obtain made complex. That is not the instance with online finance applications that provide a straight transfer alternative. Instant lending apps use instant personal financings in the range of Rs.

5,00,000 - best personal loans. You can use an immediate loan as per your eligibility as well as need from immediate financing applications. So, you don't have to stress the next time you wish to make use of a small-ticket car loan as you know exactly how advantageous it is to take a loan using online car loan apps. Do away with the lengthy as well as tedious process of availing of traditional individual financings.

10 Simple Techniques For Instant Loan

By digitizing and automating the loaning procedure, the system is transforming traditional banks right into electronic lenders. In this short article, allow's discover the benefits that a digital financing system can bring to the table: what's in it for both banks and also their consumers, as well as how electronic loaning systems are interfering with the market.They can even check the financial institution statements for information within only seconds. These functions help to ensure a quick as well as practical user experience. The digital financial landscape is now more vibrant than ever. Every financial institution currently desires everything, consisting of loans, to be processed instantly in real-time. Consumers are no more happy to wait on additional reading days - and also to leave their houses - for a finance.

Top Guidelines Of Instant Cash Advance App

All of their everyday activities, consisting of economic transactions for all their tasks and also they like doing their monetary transactions on it too. They want the benefit of making transactions or applying for a lending anytime from anywhere - loan apps.In this case, electronic financing platforms serve as a one-stop option with little hands-on information input as well as quick turnaround time from funding application to cash in the account. Customers should have the ability to relocate effortlessly from one gadget to another to finish the application, be it the internet and also mobile user interfaces.

Providers of electronic lending systems are called for to make their items in compliance with these regulations and also help the loan providers focus on their business just. Lenders likewise should see to it that the carriers are updated with all the most recent guidelines provided by the Regulators to rapidly integrate them right into the digital financing platform.

The Main Principles Of Instant Cash Advance App

As time passes, digital lending systems can conserve 30 to 50% overhead costs. The traditional hands-on financing system was a pain for both lender and also borrower. It relies on human intervention and also physical communication at every step. Clients had to make multiple journeys to the financial institutions as well as submit all kinds of records, as well as manually load out several kinds.The Digital Lending system has changed the way banks assume concerning and also apply their funding procurement. Financial institutions can currently deploy a fully-digital funding cycle leveraging the additional hints most up to date innovations. A terrific electronic lending system must have easy application submission, fast authorizations, compliant financing procedures, and also the ability to consistently boost process efficiency.

Consumers will have to look to non-bank sources of financing." It is necessary to keep in mind that loaning is an extremely rewarding fintech industry, where 28% of look here the leading 50 fintech firms operate. If you're thinking of going into lending, these are comforting numbers. At its core, fintech is all concerning making typical monetary processes faster as well as extra reliable.

The Best Guide To Instant Loan

One of the usual false impressions is that fintech apps just profit banks. That's not completely real. The application of fintech is currently spilling from financial institutions and lending institutions to tiny services. This isn't unusual, considering that local business need automation as well as digital innovation to maximize their limited sources. Marwan Forzley, chief executive officer of the repayment platform Veem, amounts it ideal: "Tiny businesses are wanting to outsource complexity to someone else due to the fact that they have enough to fret about.A Kearney research backs this up: Source: Kearney As you can see, the ease of use covers the list, demonstrating how accessibility and also benefit given by fintech platforms stand for a huge motorist for customer commitment. You can use several fintech advancements to drive consumer trust fund and also retention for businesses.

Report this wiki page